First-time AmSecure Activation via AmBank ATM

Click here for Bahasa Malaysia version.

Effective 17 March 2025, AmSecure activation on a NEW MOBILE DEVICE must be performed at an AmBank ATM.

If you have already activated your AmSecure on AmOnline prior to 17 March 2025, no action is required unless you switch to a new mobile device. For details, refer to our FAQ.

Kindly follow these simple steps below to activate your AmSecure:

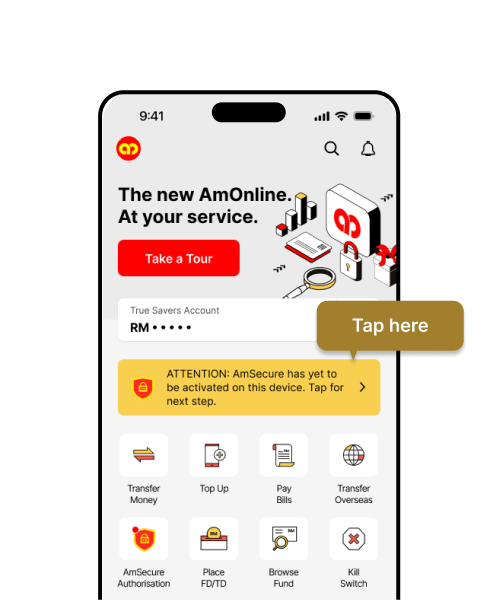

Part 1: On the AmOnline App

STEP 1

Launch the AmOnline App and follow the on-screen instructions to open a Savings/Savings-i or Current/Current-i Account.

STEP 2

On the main dashboard, tap on the Task Bar to get started.

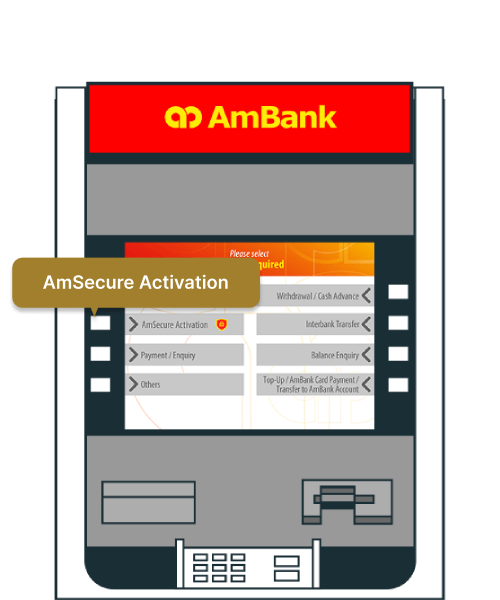

Part 2: At the AmBank ATM

STEP 3

On the Main Menu, select “AmSecure Activation”

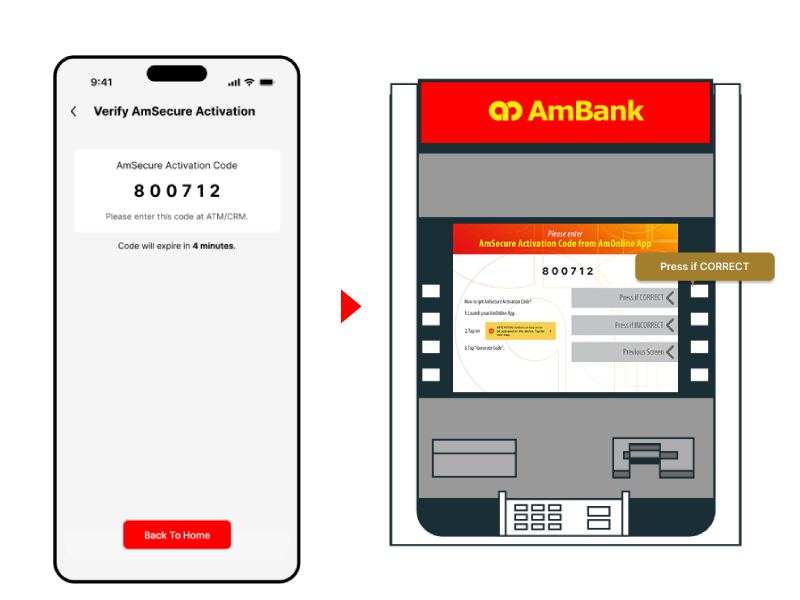

STEP 4

Tap “Generate Code” on the AmOnline App.

STEP 5

Enter the 6-digit code generated from the AmOnline App and tap “Press if CORRECT”.

Once you have activated AmSecure on AmOnline App, there will be a minimum 12-hour cooling period before you will be able to use AmSecure to approve transactions. This helps to prevent unauthorised AmSecure activation.

Learn more about AmSecure here.

For more information, please call our Contact Centre at +603-2178 8888, operational daily from 7.00 a.m. to 11.00 p.m. or email to customercare@ambankgroup.com.

Frequently Asked Questions

Q1: What is AmSecure?

AmSecure, our advanced security system that ensures only you can approve transactions, whether you are transacting via the AmOnline App, approving online transaction using debit/credit card-i or other services.

Q2. I have activated AmSecure on the AmOnline App. Will this affect me?

No. If you have already activated AmSecure on AmOnline App, you may continue to approve transactions as usual until the point in time where you switch to a new device from 17 March 2025 onwards.

Q3. I have activated AmSecure on the AmOnline App but I will need to change to a new device from 17 March 2025 onwards. Will this affect me?

If you are changing to a new device from 17 March 2025 onwards, you will need to re-activate AmSecure at an AmBank ATM. Kindly follow the steps shown above.

Q4: Must I activate AmSecure within a given period?

Yes, AmSecure must be activated within ninety (90) calendar days. If activation is not performed within ninety (90) days, you will need to re-login to your AmOnline App to rebind your device again.

Q5: I am overseas right now and have to activate AmSecure in order to perform transactions. What should I do?

Kindly contact the Contact Centre at +603-2178 8888, operational daily from 7.00 a.m. to 11.00 p.m. after downloading and logging into the AmOnline App.

Q6: What if the customer does not hold any AmBank Debit/Credit Card-i?

Kindly visit your nearest AmBank/AmBank Islamic branch for further assistance.