Key Benefits

![]()

Low Interest/ management fees rate

![]()

Zero Fee

![]()

Hassle-Free

Outstanding Credit Card/Credit Card-i balances will be automatically converted to 36 months installment plan

![]()

Flexibility

Allowing you an option to opt out from future conversion

Key Features

![]()

Advance Notice with Opt-Out Option

![]()

Pay Conveniently

![]()

Pay Consistently

![]()

Favourable Conversion

![]()

Minimum Conversion Threshold

![]()

Calculation for Convertible Amount

About Auto Balance Conversion

The Programme is only for Cardholders with the following criteria (“Eligible Cardholder”):

- Malaysian with an annual income of not exceeding Ringgit Malaysia Sixty Thousand (RM60,000) as per latest Bank’s record;

- average payment ratio for the previous twelve (12) months does not exceed 10% (i.e. for the past twelve (12) months where average payment made of 10% or less of outstanding balances);

- consistent revolver over the past twelve (12) months (i.e. the Eligible Cardholder has not made any full payment of his statement balance over the past twelve (12) months

- Credit Card/Credit Card-i account is current and not delinquent at the point of conversion;

NOTE:

- You will not qualify for future auto conversion if your monthly income is above RM5,000.

- You will continue to pay down any outstanding instalments from earlier converted balances.

- You are encouraged to keep your credit card issuer updated on any changes to your income level. Please contact your credit card issuer for the details on income update.

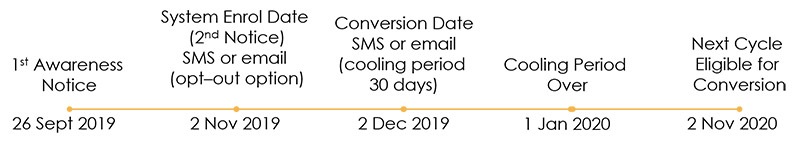

- Your Auto Balance Conversion will start upon successful enrollment which will be communicated to you via SMS or email notification to your registered mobile number or electronic Direct Mailer (eDM)

- The outstanding balance on Credit Card/Credit Card-i will be reviewed on your statement date to verify if it meets the minimum criteria for conversion

- Your outstanding balance will be converted into 36 months instalment plan at Effective Interest/management fees rate 13% p.a

- Your monthly payment will be reflected on your Credit Card/Credit Card-i statement

To opt out from this programme, you can call our Contact Centre at +603 2178 8888; or email [email protected]

Upon opt-out, your credit card issuer will not convert your credit card balance to an instalment plan at that point in time. Your credit card next balance conversion offer 12 months later if you meet the eligibility criteria.

Upon conversion of your credit card/-i balance, you are allowed to cancel within 30 days (cooling-off period) from the date of conversion without any termination fee. This cooling-off period only applies to 1st time conversion.

If you opt to cancel the instalment plan during the 3-year tenure, you will have to pay the outstanding principal in full*.

* For credit card-i, rebate is applicable (if any), for early settlement of the instalment plan. Please refer to the T&C for more details.

For existing Auto Balance Conversion, your monthly payment will still continue until the end of instalment payment plan period. Alternatively, you can choose to make full payment to pay off your existing Auto Balance Conversion.

Conversion flow

- Minimum payment due is 5% of statement balance. Customer makes minimum payment due (5%) monthly.

- There is no new retail spend or cash advance following the conversion.

- The outstanding balance consists of retail spend only and revolves at 17%p.a.

- The monthly instalment amount from Auto Balance Conversion is RM320 and to be paid in full as part of minimum payment due.